Economic Overview

Global Economy

The economic environment in 2013 began on a weak note but the second half of the year fared better, setting a positive tone for 2014. Economic growth clocked an average of 3.7 % during the second half of the year, a marked improvement from 2.7% in the first half. A major contributor to this growth was the United States which grew at 3.2% during the second half. Overall, the global economy for the year ended at 3% as against 3.2% the previous year.

During the second half of the year, most macro indicators saw considerable improvement, underlining the gradual strengthening of the global economy. Steady improvement in the US economy led to considerable fall in its unemployment rate to 6.3% in April 2014, the lowest since September 2008, and much better than projected at the start of the year. Europe also recovered and saw its growth turning positive in the second half of the year, after six consecutive quarters of contraction.

According to the forecast by International Monetary Fund (IMF),the global growth is projected to strengthen from 3% to 3.6% in 2014 and 3.9% in 2015. The economic growth in advanced economies is expected to increase to about 2.3% in 2014. The growth in the European region is expected to be varied but weaker in countries with high debt.

In Japan, some underlying growth drivers are expected to strengthen, notably private investment and exports given the substantial yen depreciation over the past 12 months.

A report by IMF states that the growth in developing economies is projected to pick up gradually from 4.7% to about 5% in 2014 and 5.3% in 2015. This growth will be helped by stronger demand from advanced economies.

Indian Economy

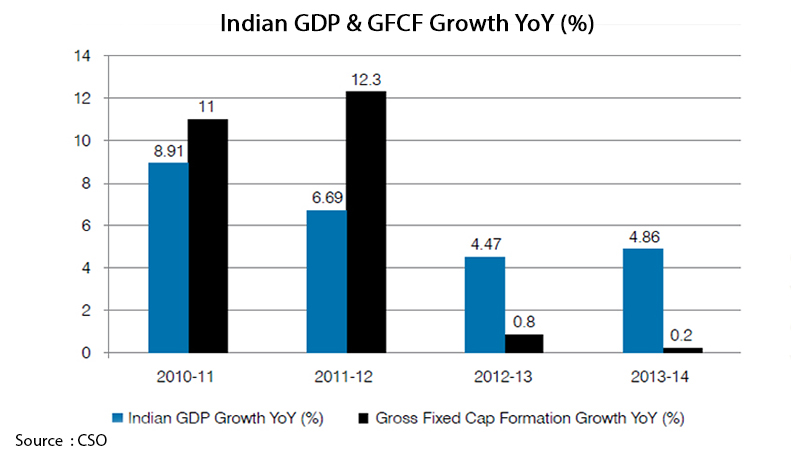

The fiscal 2013-14 (FY14) proved to be another challenging year for the Indian Economy. A slew of factors such as delays in regulatory approvals, laggard execution of infrastructure & industrial projects, significant drop in corporate investments and higher interest rates led to moderation in the country’s growth momentum.

The Central Statistics Office (CSO) has estimated that the Indian economy expanded at 4.7% in FY14, marginally higher than the 4.5% growth recorded in FY13. However, for the second consecutive year, the economic growth remained below the 5% mark.

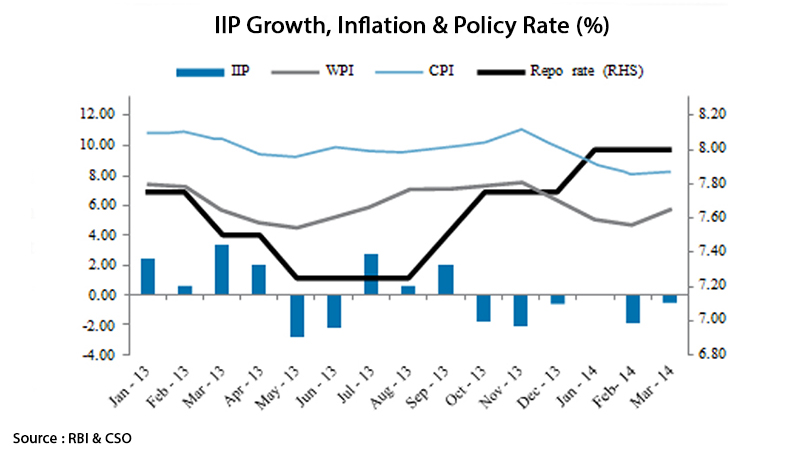

Agriculture and exports witnessed strong growth while the economy was pulled down by manufacturing which witnessed contraction this year for the first time since 1991-92. Inflation,especially the consumer price index(CPI),remained uncomfortably high during the year,resulting in higher interest rates. The high interest rates in turn impacted the overall investment environment. The Index of Industrial Production(IIP)remained in the negative zone for most part of the year.

In line with global macroeconomic environment, India saw considerable improvement in most of its key macro-economic variables in the second half of the year. While the domestic confidence remained weak, high interest of foreign investors was visible through the sharp surge in the foreign capital coming in to India. The dramatic improvement in the current account deficit (CAD), from 6.7% in Q3FY13 to 0.9% in Q3FY14, along with the increase in capital account surplus led to considerable improvement in balance of payments.

In its annual report on the state of the Indian economy, the IMF said that India has restored its macroeconomic and financial stability, but persistently high inflation remains a key concern. The report stated that although spill overs from global financial market volatility continue to pose a significant risk, the Indian economy is now better placed to handle financial shocks. The Confederation of Indian Industries (CII) expects some pick up in investment as the de-clogging of the project pipeline would help revive demand in the economy.

Real Estate Sector

The volatility in the global economy led to a considerable reduction in the FDI flow into the Indian real estate sector in the last two years.

During the year, all four key segments of Real estate sector viz. Residential, Commercial, Retail and Hospitality witnessed subdued growth.

The demand was impacted by a slew of factors including restrained spending by corporate and individual buyers, high inflation, high borrowing cost and tightening lending norms. Overall, buyers and investors maintained a cautious outlook due to macroeconomic and policy uncertainties.

On the positive side, the government stepped in and took a few positive steps that would help to enhance transparency and revive long term demand for the sector. SEBI introduced a draft regulatory framework for Real Estate Investment Trusts (REITs) that once legislated, will help to enhance liquidity of real estate. Another positive development during the year was the introduction of Real Estate Bill that proposes to set up a real estate regulator for every state and union territory. This will help to enhance the confidence of end users and investors thereby boosting new investment into the sector. The third important development was enactment of Rehabilitation and Resettlement Act that promises to fairly compensate the land owners for their land and re-settlement charges.

The year 2013 witnessed a steep 65% decline in investments made in the real estate sector to USD 1.2 billion against USD 3.4 billion in the year 2012. The total investments in the residential segment saw an increase of 42% to ₹ 4,050 crores during the year 2013. The private equity inflows in realty sector saw a 13% increase to INR 7,000 crores compared to INR 6,200 crores during the year 2012.

The first quarter of 2014 recorded a robust growth in private equity inflows into the real estate sector and was the highest since the second quarter of 2009. The inflows recorded at USD

460 million or

₹ 2,800 crores grew at close to 150% compared to Q12013. Bengaluru received over two third of these inflows followed by Mumbai. (Source: Cushman & Wakefield)

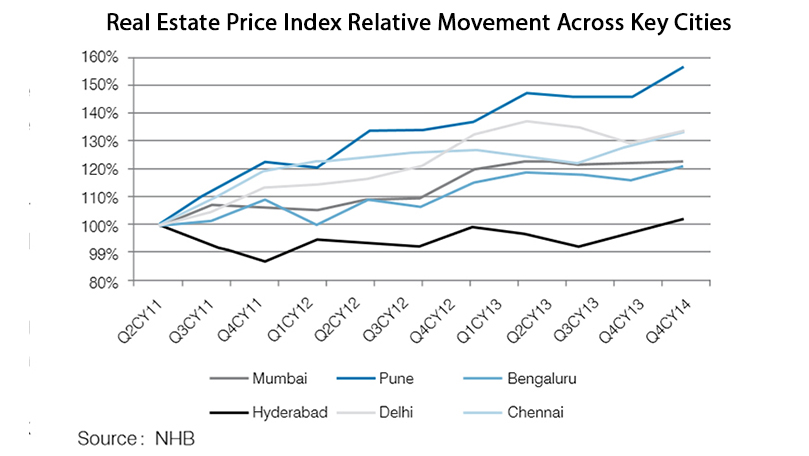

Residential

As per a report by Cushman & Wakefield, the residential project launches during the year saw a decline of 12%. Of our key focus markets, Mumbai and Bengaluru saw a growth of 6% and 15% respectively, while Pune saw a decline of 20% in new project launches. The capital value in most of our key focus markets increased, albeit modestly, during the financial year .

During the year, the demand for residential properties was impacted by high inflation and higher cost of borrowing. Developers also saw challenges in form of higher input cost, labour shortages, and difficulties in raising fresh capital,high interest rates and delays in regulatory approvals.

The shortage of residential apartments is likely to continue over the medium to long term due to increasing percentage of working age population, fast growing urbanization and demographic shift. A Cushman & Wakefield report indicates a demand of 12 million new units over the five year period from 2013 to 2017. The report further states that in the top eight cities, the demand supply gap is likely to be around 45%.

Commercial

The demand for commercial space is driven by outsourcing industries like IT-BPM, BFSI and manufacturing. Commercial real estate has been one of the most impacted segments due to the economic slowdown and also due to the extreme caution exercised by corporate resulting in sharp reduction in new investments.

A report by Cushman & Wakefield states that in the year 2013, the net absorption of office leasing space, across the top eight Indian cities declined by 25% to 23 million sq. ft. over the previous year. Pune was the only city to see a demand growth of 15% during the year. Helped by 14% decline in new supply, vacancy rates saw a marginal 60 bps increase to 19.4% at the end of 2013.

Going forward, the improving economic outlook of developed economies should lead to more demand from export oriented sectors such as IT-BPM and pharmaceuticals. During the first quarter of 2014, the demand for office leasing space increased by a sharp 58% to 5.9 million sq. ft. over 2013. New banking licences along with projected recovery of the Indian economy should further accelerate the demand for organized commercial space over the next few years.

Business Overview

Peninsula Land Limited is one of the most trusted real estate companies in India. Headquartered at Mumbai, the company is part of Ashok Piramal Group, a leading Indian conglomerate having business interests in textiles, auto engineering, cutting tools, renewable energy and sports besides real estate.

Since Peninsula Land is present across various segments the Company possesses thorough knowledge of key issues and challenges of developing real estate. Across all segments, Peninsula land has delivered 6.4 mn sq. ft. and has 16 mn sq. ft. in pipeline across west and south India.

Peninsula land is one of the first companies to develop premium residential projects in Central Mumbai. For a city starved of space, Ashok Towers and Ashok Gardens are examples of premium residential complexes that scores on construction quality, spacious design and finest recreational options.

After establishing itself in Mumbai, Peninsula Land has strategically expanded its footprints to include the newly established cities of Bengaluru, Pune and popular vacation destinations. Peninsula Land’s current product portfolio includes modern luxury apartments, vacation homes and weekend villas.

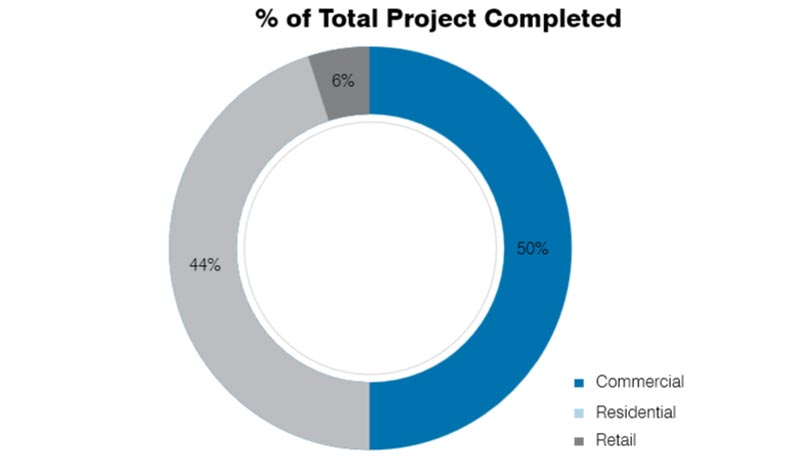

Snapshot of Past Projects

Since inception, Peninsula Land has developed projects aggregating to 6.4 million square feet that at prevailing market price is valued at ₹ 14,000 crores. Almost half of the space developed was for commercial projects and the bulk of remaining was high end residential. A little over 6% of the space developed was for retail projects.

| Projects | Type |

|---|---|

| Peninsula Corporate Park | Commercial |

| Peninsula Centre | Commercial |

| Center Point | Commercial |

| Peninsula Business Park | Commercial |

| Peninsula Technopark | Commercial |

| Kanjur Marg | Low income housing project |

| Palm Beach | Residential |

| Ashok Towers | Residential |

| Ashok Gardens | Residential |

| Crossroads | Retail |

| Bayside Mall | Retail |

| CR2 | Retail |

Business Segment Review

During the year, Peninsula Land focused on strengthening its business fundamentals. It worked on initiatives to improve costs, introduce best-in-class operations processes, and put in place an effective organization structure that brought about better accountability and responsibility.

Peninsula Land transitioned from a functional organization to a project-based organization. A Chief Operating Officer (COO) was appointed to oversee all operations. Individual projects were allocated to Clusters, which now comprise of cross functional teams that look after architectural design, planning, costing and construction at site.

This model is highly scalable as new clusters can be added/ re-allocated as per the business requirements. The COOs office was augmented by functional experts and a centralised Procurements and Contracts team to service the various clusters.

We launched new projects in Mumbai and Pune and completed the groundwork to launch our first project in Bengaluru. Mumbai, Pune and Bengaluru continue to remain our key focus markets and we are witnessing traction in each of these markets.

Projects Currently Under Execution

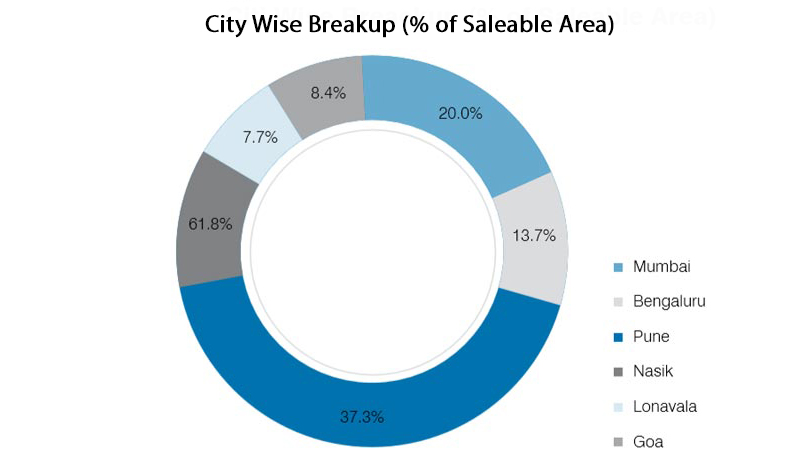

Currently, Peninsula Land is developing approximately 2.3 million square feet of residential space. While bulk of this space is expected to be developed over the next two to three years, a few large projects are projected to be completed in the medium to long term. Of this around 0.8 mn square feet aggregating around ₹ 795 crores has already been sold.

Mumbai

Bishopsgate

Peninsula Land is currently executing a high-end residential project named Bishopsgate, on Bhulabai Desai Road, with a total saleable area of 86,000 sq. ft. The project is a Joint Venture with KBK Group where Peninsula Land has a 50% stake. The land along with a five-storey residential building was acquired two years back for a consideration of ₹ 290 crores. Close to 55% of the project has already been sold.

Celestia Spaces (Phase I)

Celestia Spaces (Phase I) is a JV with the landowner, HEM Bhattad and located at Sewree in Central Mumbai. Peninsula Land holds a 64% share in the project. Peninsula Land is responsible for executing the project and will get 479,000 sq. ft. of the saleable area. It has made a payment of ₹ 144 crores for the development right of the land. The project is designed by Hafeez Contractor and close to 12% of the project has already been sold.

Pune

Ashok Meadows (Phase 1)

Peninsula Land is currently executing phase 1 of a residential project by the name of Ashok Meadows in Hinjewadi, Pune. The total saleable area of the project is 2.0 mn sq. ft. while the saleable area under Phase 1 that is currently being executed is 498,000 sq. ft. The project is a joint venture between Clover Realty, Peninsula Land and Peninsula Realty Fund (a subsidiary of Peninsula Land). Peninsula Land has 55% stake in the project while another 30% is with Peninsula Realty Fund.

The project is advantageously located in phase 1 of Hinjewadi in proximity to one of the most promising upcoming IT hub in India that houses 20 of India’s biggest IT companies and International software giants. The project land was acquired for a total consideration of ₹ 150 crores. The project has witnessed strong interest and close to 261,000 sq. ft. of area has already been sold. The project is designed by a Singapore based firm, Man Kok Pvt. Ltd.

Nashik

Ashok Astoria

Peninsula Land is currently executing a premium residential complex spread across 18 acres called Ashok Astoria located near Sula Vineyards. The total saleable area is of 589,000 sq. ft. The land for the projects was acquired for a consideration of ₹ 18 crores.

The complex provides numerous amenities including a fully equipped Club Peninsula, tennis and squash courts; swimming pools, Bayside Plaza - a shopping, leisure and entertainment centre; landscaped gardens created by Singapore based Taib Landscape Studio . The project is progressing as per plan and close to half of the project has been sold. The project is designed by Hafeez Contractor.

Lonavala

Ashok Nirvaan

Peninsula Land is currently executing a second home project of bespoke villas called Ashok Nirvaan with a total saleable area of 352,000 sq. ft. The project spread across 17 acres is located amongst the serene hills of Lonavala adjacent to the Old Mumbai Pune Road.

The land for the project was acquired for a consideration of ₹ 33 crores. The project is a Joint Venture with Peninsula Realty Fund. The project is progressing as per plan, and 30% of the project has already been sold. The project is designed by renowned architect G Fab.

Goa

Ashok Beleza

Peninsula Land is currently executing a residential project called Ashok Beleza, near the Betim hills across the river Mandovi with a total saleable area of 247,000 sq. ft. Ashok Beleza is at a vantage location and enjoys easy access to the North, South and interiors of Goa. Its modern architecture along with wide open spaces is in perfect harmony with the serene, laid-back charm of Goa.

The land for the project was acquired for a total consideration of ₹ 57 crores. The project is a Joint Venture with Peninsula Realty Fund. The project is designed by Kapadia Associates Pvt. Ltd.

Snapshot of Projects Currently Under Execution

Listed below are the projects which are currently under execution, aggregating to approx. 4.6 mn sq. ft. of saleable area:

| Projects | Location | Type | Saleable Area (sq. ft.) |

|---|---|---|---|

| Bishopsgate | Mumbai | Residential | 86000 |

| Celestia Spaces (Phase I) | Mumbai | Residential | 479000 |

| Ashok Meadows (Phase 1) | Pune | Residential | 498000 |

| Ashok Astoria | Nasik | Residential | 589000 |

| Ashok Nirvaan | Lonavala | Residential | 352000 |

| Ashok Beleza | Goa | Residential | 247000 |

Projects in Pipeline

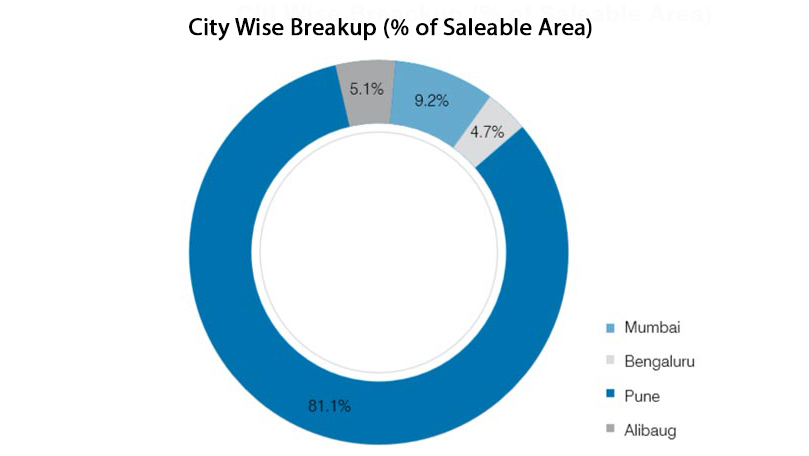

Peninsula Land has close to 16 mn sq. ft. of saleable area near ready to be executed. Close to 96% of this is located in established IT-BPM /BFSI hubs and high growth markets viz Mumbai, Pune and Bengaluru.

Mumbai

Carmichael Road, South Mumbai

Peninsula Land has acquired land with a development potential of 143,000 sq. ft. in one of the premium locations in South Mumbai. The project is a JV with KBK Group. Peninsula land has 40% share is this project. The land for the project was acquired for a consideration of ₹ 394 crores. The project will be designed by a leading global architect, Skidmore Owings & Merrill from New York.

Napeansea Road, South Mumbai

Peninsula Land has acquired land with a development potential of 49,000 sq. ft. at Napeansea Road in South Mumbai. It has entered into a JV with Peninsula Realty Fund for executing this project. The land for the project was acquired for a consideration of ₹ 124 crores. The project is going to be designed by one of the most renowned architects, Hafeez Contractor.

Celestia Spaces (Phase II), Sewree

This project is located adjacent to Celestica Spaces Phase – I in Central Mumbai and has a total development potential of 1.2 mn sq. ft. The project is under cluster redevelopment. Peninsula Land will undertake various project management services specific to the project and will have 8% share in the revenue. The project will be designed by one of the most renowned Indian architect Hafeez Contractor.

Pune

Ashok Meadows (Phase 2&3), Hinjewadi Phase 1

The Phase 2 & 3 of Ashok Meadows in Hinjewadi, Pune has a total saleable area of a little over 1.5 mn sq. ft. The project is a Joint Venture with Clover Realty and Peninsula Land has 55% stake in the project while Company’s subsidiary Peninsula Realty Fund has another 30% stake.

Tathavade

Peninsula Land would soon execute a mixed use project in Tathavade with a total saleable area of a little over 0.77 mn sq. ft. The complete land required for the project has been acquired for ₹ 75 crores. The project is a JV with JMM and Clovers Realty and Peninsula Land has 56% stake in it. The project is designed by RSP Design Consultants (India) Pvt. Ltd.

Mamurdi Gahunje

This is Peninsula Land’s largest project yet to be executed with a total saleable area of 10 mn sq. ft. and has a vantage location near the end of Mumbai – Pune Expressway. The land for the project was acquired for ₹ 370 crores. The project is designed by Edifice Architects Private Limited.

Bengaluru

Ashok Heights

Peninsula Land is currently executing its first project in Bangalore called Ashok Heights. Located in J.P. Nagar, the residential project has a total saleable area of 618,000 sq. ft. The land for the project has already been acquired for a total consideration of ₹ 140 crores. The project is a JV with Peninsula Realty Fund where Peninsula Land has 80% stake in the project. The project is designed by HBA Design, a Singapore based company.

Alibaug

Peninsula Land plans to start a residential project in Sogaon with a total saleable area of 638,000 sq. ft. The land for the project has been acquired for a consideration of ₹ 32 crores. The project is a JV with Samira Habitats where Peninsula Land has 85% stake. The project is designed by G Fab.

Snapshot of Projects in the Pipeline

Following table gives the snapshot of the project that the Company plans to start over the next few years, aggregating close to 16.1 million sq. ft. of saleable area:

| Projects | Location | Types | Saleable |

|---|---|---|---|

| Carmichael Road | Mumbai | Residential | 143,000 |

| Celestia Spaces–(Phase II) | Mumbai | Residential | 1,200,000 |

| Napeansea Road | Mumbai | Residential | 49,000 |

| Tathavade | Pune | Mixed Use | 772,000 |

| Mamurdi Gahunje | Pune | Residential | 10,000,000 |

| Ashok Meadows –Phase 2 and 3 | Pune | Residential | 1,502,000 |

| Ashok Heights | Bengaluru | Residential | 618,000 |

| Mahadeopura | Bengaluru | Residential | 631,000 |

| Alibaug Samira | Alibaug | Residential | 638,000 |

| Saral | Alibaug | Residential | 50,000 |

Outlook

Over the last few years, both commercial and housing sectors have seen stagnation in demand. Going forward, gradual improvement in most macroeconomic indicators and reduction in borrowing cost may help the sector to revive its growth momentum. Most economists expect an improvement in the economic growth in the next 2-3 years.

The depreciation of INR against dollar and euro has made India an attractive outsourcing destination. Steady recovery in most advanced economies would also help to create more outsourcing jobs from sectors such as IT-BPM, consulting, research, BFSI, pharmaceuticals and this would also aid in improving the real estate demand.

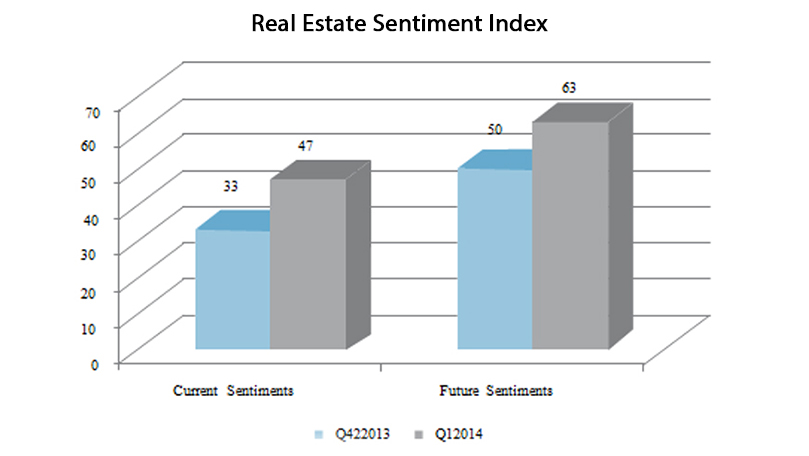

As per a Q12014 Knight Frank report on real estate sentiment index, there has been a marked improvement in both current and future sentiments in just a three month period. Further, the number of positive steps taken in the budget such as reduction in the minimum capitalization and project size required for FDI, extension of tax incentives to individual housing loan borrowers and introduction of REITs and development plan for 100 smart cities would significantly aid the sector’s growth.

Risk Management

Risk is an integral part of any business transaction. In today’s device independent and location independent globalized world, the increasing integration of new resources demand equivalent strengthening of the risk management systems. For a capital intensive company like ours, a robust risk assessment and mitigation framework becomes critical for long term sustenance.

We have a robust risk management framework that facilitates risk assessment and mitigation procedure, lays down reporting procedure and enables timely reviews by the management. Our key risk areas are similar to other players in the business of real estate development. A few of the key risks and the mitigation measures are as follows:

| Risk | Description | Mitigation Plan |

|---|---|---|

| Economic Risk | Real estate being a capital intensive industry has very strong correlation with both domestic and global growth. A slowdown can restraint both fresh demand and availability of capital. | Peninsula Land has defined internal prudential norms to cap adverse risk to company’s sustainability. Its land bank are at vantage locations and comparatively more liquid, the Company maintains a low debt equity ratio, comfortable liquidity, strong brand premium and focus on select markets and minimize the impact of adverse macroeconomic conditions. |

| Execution Risk | Execution delay may results in cost overruns and may also negatively impact company’s reputation and returns. A real estate project generally is a long gestation project that generally spans across years and delays can cost dearly in form of higher than expected input cost and higher than anticipated interest burden. | Peninsula Land has put in place processes that include milestone based time & quality checks that help to ensure adherence to quality, cost and delivery as per the plan. The Company deploys a well-defined standard operating procedure – from project planning to delivery – and adheres to rigorous internal checks and balances with regard to every project. Additionally, the Company launches its project in phased manner that ensures minimal impact of market volatility and ability to match supply with the current market demand. |

| Land Acquisition Risk | Well located land bank is the scarcest raw material in India. Additionally, in most of our focus markets, it forms major component of overall expenditure. Delay in land acquisition due to title ambiguity, interference from local residents or any other reason can have a significant impact on the company. | Peninsula Land does a multi-level due diligence to verify title ownership and its immediate availability before taking final decision. The Company has a pool of competent counsels and also hires external consultant as required. |

| Contractor/ sub- contractor performance | Risk to earnings arising from vendor’s failure to meet the terms as stated in the contract. A vendor may not be able or willing to meet the commitment as indicated in the contract | Given the strong history and lineage of Peninsula Land, the Company has developed a list of preferred vendors and strong working relationship with them. The Company due to its close association is also aware of their financial condition |

| Input Price Risk | Risk to earnings arising from the volatility in the price of key inputs. Many of the real estate projects are usually sold on “no price escalation” basis, leaving the adverse impact of rise in input cost to be borne by the Company. Also given that real estate projects generally are long gestation project, the likely hood of such event happening is high | Peninsula Land takes this risk into account at the time of launch, and usually sells the projects in a phased manner. The Company is able to pass the hike in input cost in form of higher realizations |

Internal Control Systems

Effective internal control systems are of paramount importance for a company like Peninsula Land where every project demands a unique set of employees and partners. The Company through a set of well-established internal control systems promotes adherence to prescribed processes and procedures, ethical conduct, transparent & reliable reporting, periodic monitoring by the designated personnel.

The Company’s internal control system ensure timely recording of all transactions, maintenance of financial records, optimal utilization of Company’s resources and preservation of Company’s assets. The Company has got a professionally managed internal team in place, which carries out the internal audits from time to time coupled with external and internal auditors. The team reviews the practices carried out by Company in following various SOPs and while executing projects. It suggests benchmark policies followed in the sector, to upgrade the methods followed by Company.

In the beginning of every year, the audit committee in consultation with independent internal auditors and the management finalizes the audit plan for the year. The committee also periodically reviews different risk and shares the finding with the management, respective owners and other stakeholders and post discussion takes appropriate timely action.

Human Resource

Peninsula Land strongly believes that employees are the most vital asset for any organization. Whatever the scope of project Peninsula Land undertakes, its location or its complexity, it involves team members exercising individuality, flair and a commitment to achieving success.

To be an employer of choice and to attract industry best talent, Peninsula Land has developed open & engaging work environment along with an attractive compensation structure. Peninsula Land’s modern training programme and meritocracy based culture motivates employees to take larger responsibilities and deliver higher level of performance. Peninsula Land has a periodic employee appraisal schemes in place that facilitate the review of employees’ performance with their managers and which seek to identify training and development needs and opportunities.

During the year, Peninsula Land developed a more effective organization structure by creating clusters that would entirely be responsible for execution of a set of two or more projects within the specified geographical location. This model allows individual to gain cross functional exposure, the flattened organization structure allows individual employees a higher visibility & reach to the Company’s senior resources and a greater opportunity to participate in both cluster and organization growth.

As on 31st March 2014, Peninsula Land had 341 employees on its payrolls.

Cautionary Statement

Certain statements in this report describing the Company’s objectives, projections, estimates, expectations or predictions may be forward looking statements within the meaning of applicable securities, laws and regulations. Although the expectations are based on reasonable assumptions, the actual results could materially differ from those expressed or implied.